Home > How It Works

Simple. Fast. Designed Around You.

Your Path to Smarter Borrowing Starts Here

What You Can Expert:

- Clear Loan Terms with No Surprises

- Personalized Support from Real People

- Flexible Repayment Plans Designed for You

- No Prepayment Fees — Pay Off Early Anytime

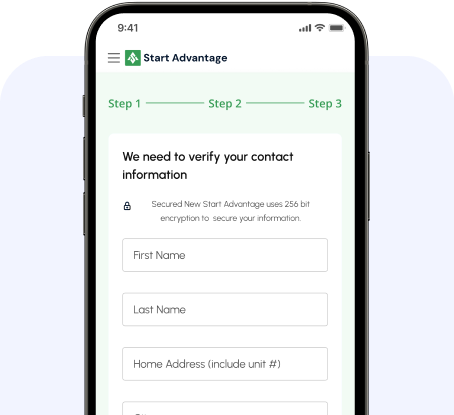

How New Start Advantage Works

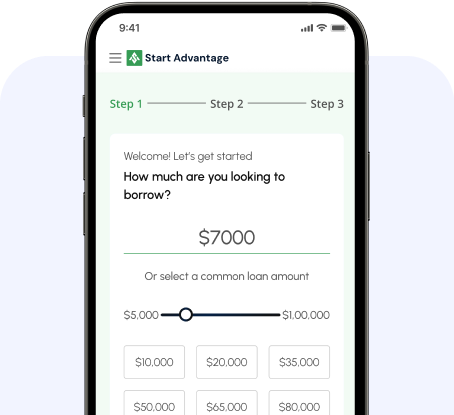

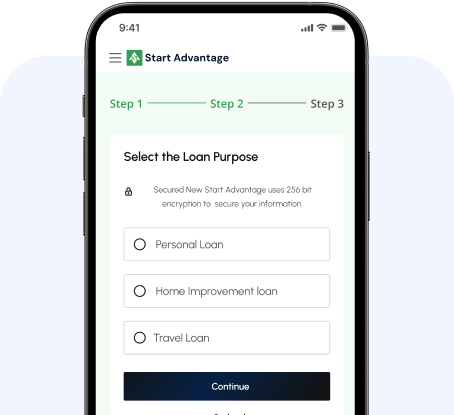

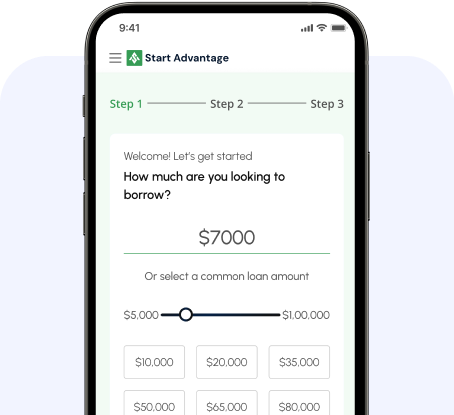

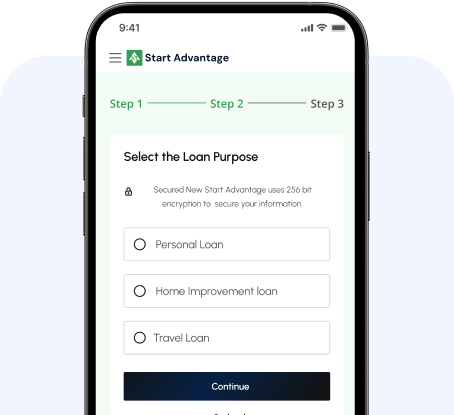

Explore Your Loan Options

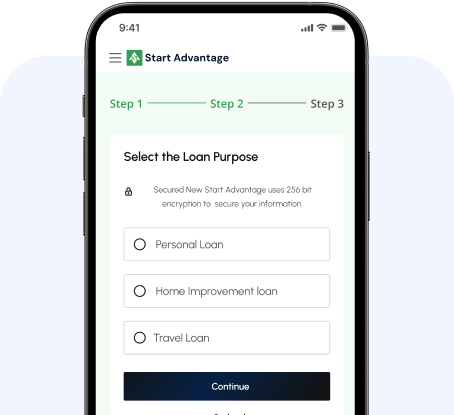

Choose Your Loan Terms

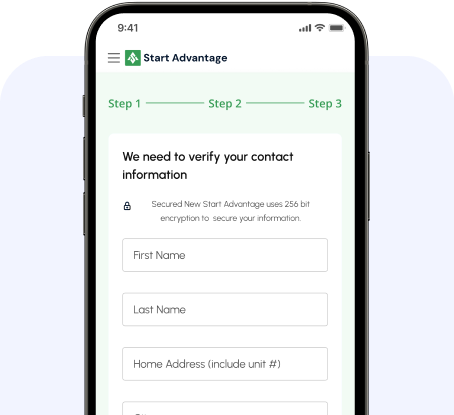

Get Fast Funding

Explore Your Loan Options

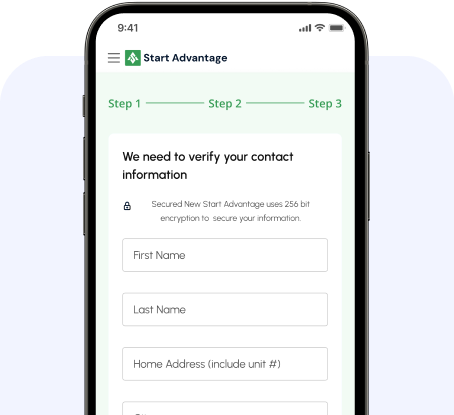

Choose Your Loan Terms

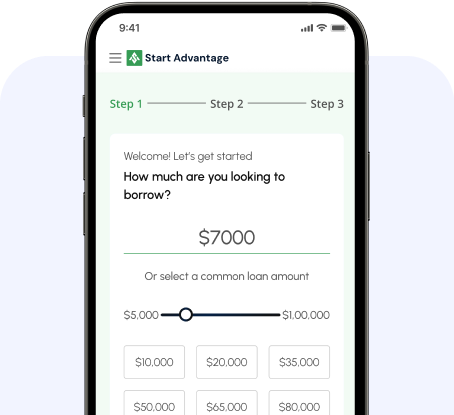

Lock in your rate with confidence. Select from 3 or 5-year loan terms with fixed rates between 6.99% and 35.99% APR. You’ll know exactly what to expect — with no hidden fees or complicated fine print.

Get Fast Funding

Explore Your Loan Options

Choose Your Loan Terms

Lock in your rate with confidence. Select from 3 or 5-year loan terms with fixed rates between 6.99% and 35.99% APR. You’ll know exactly what to expect — with no hidden fees or complicated fine print.

Get Fast Funding

Explore Your Loan Options

Choose Your Loan Terms

Lock in your rate with confidence. Select from 3 or 5-year loan terms with fixed rates between 6.99% and 35.99% APR. You’ll know exactly what to expect — with no hidden fees or complicated fine print.

Get Fast Funding

What Makes New Start Advantage Different?

- Tailored Repayment Plans — Find a monthly payment that fits your budget.

- No Prepayment Penalties — Pay off your loan early, anytime, without extra charges.

- Secure & Private — Your information is protected with industry-leading security.

- Ongoing Support — We're here to help beyond just the loan process.

Frequently asked questions

How do I apply for a loan with New Start Advantage?

Will checking my rates impact my credit score?

What types of expenses can I use a personal loan for?

How much can I borrow?

How quickly can I receive my funds?

Are there any hidden fees or early payoff penalties?

How do I make my monthly payments?

What if I have more questions?

Start Your Financial Journey with Confidence

At New Start Advantage, we’re here to make financing feel simple, supportive, and built around your goals — not someone else’s rules.

Getting started is easy — and checking your rates won’t impact your credit score.

Let’s move forward — together.