Home Improvement Loan

Bring Your Home Projects to Life with a Home Improvement Loan from New Start Advantage

- Flexible Financing for Big & Small Projects

- Clear Rates with No Hidden Fees

- Fast, Hassle-Free Application Process

*Checking your rates won’t affect your credit score.

Why New Start Advantage?

Why Choose New Start Advantage for Home Improvement Loans?

Simple Process, Personalized Support

Get the funds you need to upgrade your home — with an easy online application and real guidance from our loan experts.

Loan Options Built Around Your Project

From kitchen remodels to outdoor upgrades, we’ll help you secure loan terms that fit your budget, timeline, and renovation goals.

No Prepayment Fees — Total Flexibility

Pay off your loan early without worrying about extra charges or hidden penalties. Freedom to repay on your terms.

How It Works

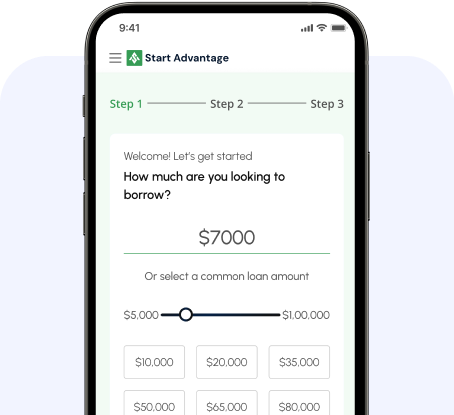

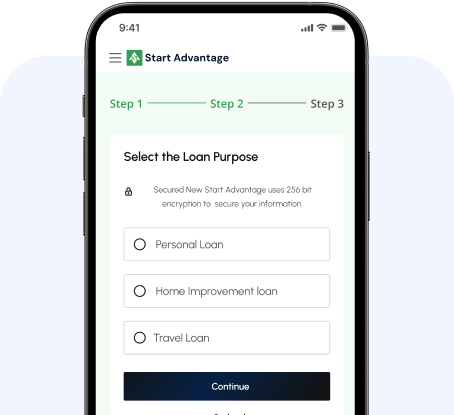

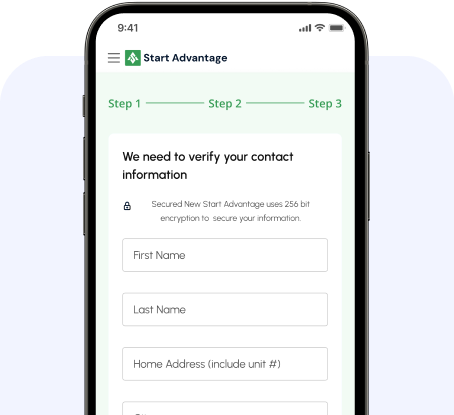

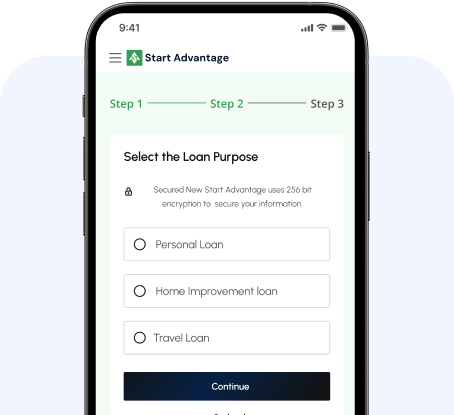

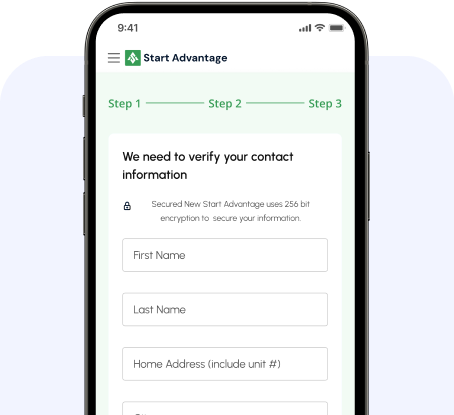

How It Works — Home Improvement Loan Made Simple

Tell Us About Your Project

Complete our quick online form with a few details about you and your home improvement plans. Choose the best time to connect with a loan advisor.

Explore Your Loan Options

Speak with a dedicated loan specialist to review your personalized offers. We’ll help you find terms that match your goals and budget.

Get Funded Fast

Once approved, you’ll receive funds directly to your account — often within just one business day — so you can start your project without delay.

Tell Us About Your Project

Complete our quick online form with a few details about you and your home improvement plans. Choose the best time to connect with a loan advisor.

Explore Your Loan Options

Speak with a dedicated loan specialist to review your personalized offers. We’ll help you find terms that match your goals and budget.

Get Funded Fast

Once approved, you’ll receive funds directly to your account — often within just one business day — so you can start your project without delay.

FAQ

Frequently asked questions

We’ve answered a few FAQs to get you started. But please don’t hesitate to reach out with more.

What is a home improvement loan?

A home improvement loan is a personal loan you can use to finance upgrades, renovations, or repairs to your home — with fixed monthly payments and flexible terms.

How do I apply for a home improvement loan with New Start Advantage?

Applying is easy. Just complete our quick online form, and a loan specialist will follow up to review your options and guide you through the next steps.

What types of projects can I use this loan for?

You can use a home improvement loan for almost any project — including kitchen remodels, bathroom upgrades, flooring, roofing, landscaping, or even energy-efficient improvements.

How much can I borrow for home improvements?

Loan amounts range from $1,000 to $50,000 — depending on your eligibility, financial profile, and the size of your project.

How fast can I receive the funds?

Most approved applicants receive funds directly into their bank account within 1 business day — so you can start your home project without delay.

Will checking my rates affect my credit score?

No. Checking your rates with New Start Advantage only requires a soft credit inquiry, which does not impact your credit score.

Are there any hidden fees or prepayment penalties?

Never. There are no prepayment penalties, and any applicable fees (like an origination fee) will always be disclosed upfront — no surprises.

How do I make payments on my home improvement loan?

You’ll make easy, fixed monthly payments through your secure New Start Advantage online account. You can also set up automatic payments for added convenience.

loan options

Explore our other Loan Options

Planning a getaway or dream vacation? Our travel loans make it easy to turn travel plans into reality — with affordable financing and flexible repayment options.

Whether you’re making a big purchase, covering unexpected expenses, or simply looking for financial breathing room — our personal loans come with competitive rates and flexible terms to fit your life.

Planning a getaway or dream vacation? Our travel loans make it easy to turn travel plans into reality — with affordable financing and flexible repayment options.

Whether you’re making a big purchase, covering unexpected expenses, or simply looking for financial breathing room — our personal loans come with competitive rates and flexible terms to fit your life.

Ready to Upgrade Your Home?

Start Your Next Project with Confidence

Turn your home improvement plans into reality with simple, flexible financing and a dedicated support team ready to help you every step of the way.